Checking Rates

APY Effective 1/22/2026*

3.04

%

APY

Member Advantage Checking

On the first $500

0.10

%

APY

Member Advantage Checking

$500.01+

0.05

%

APY

Checking

Checking Account Features and Benefits

BECU checking accounts include features to help you manage your money with confidence, including:

- Convenience — We offer a large network of locations and nationwide access to over 77,000 surcharge-free ATMs.

- Save money — No balance requirements or monthly maintenance fees, plus receive a free Debit Mastercard® with fraud protection.2

- Save time — 24/7 access to your money including free Online Banking and Mobile Banking through our app.3

- Security — FICO Score check in Online Banking.

- Safety — Your money is federally insured by NCUA up to $250,000.

Why Choose BECU for Your Checking Account?

BECU is a not-for-profit credit union that puts members first. We don't answer to shareholders — we answer to you. That means:

Convenient locations and services, including full digital banking.

Local service and decisioning.

Low fees and transparent account terms.

Competitive rates.

Budgeting tools to help you stay on top of your spending.

Free Financial Health Check appointments to receive guidance from a BECU certified financial coach.

As a member-owned credit union, BECU reinvests in members and the community through local discounts, giving programs, webinars and seminars, and financial wellness resources. Learn how credit unions compare to banks.

Member Advantage Checking: More Value from Your Membership

Member Advantage Checking4 does more than cover everyday banking needs. It can help you grow your money faster with a premium rate on your balance up to $500. Plus, you could enjoy better rates with CDs, IRA CDs or Money Market Accounts.

To qualify, you'll need to open a Member Advantage Checking and Savings account and meet a few simple requirements. See full Member Advantage qualification requirements.

Member Advantage Checking vs. Checking

Both accounts come with no monthly maintenance fee, no minimum balance and full access to online and mobile banking.

Member Advantage Checking is also free, but members get:

- A premium interest rate on their first $500 in the account.

- Higher interest rates on CDs, IRA CDs and Money Market Accounts.

Digital Banking with Your BECU Checking Account

Online Banking

Full Account Access

Access your BECU accounts anytime through Online Banking. Manage your finances, open new accounts and apply for loans from your computer or mobile browser.

- View account balances and transaction history.

- Pay bills and transfer money.

- View eStatements.

- Manage your debit card.

- Set up two-factor authentication, transaction alerts and more.

BECU Mobile App

Everyday Banking Made Easy

The BECU mobile app makes it easy to check balances, deposit checks, and manage your debit card on the go.

- View balances and transaction history.

- Pay bills or send money with Zelle®.

- Deposit checks from your phone.

- Pause your debit card.

- View budgets, alerts and more.

No Monthly Maintenance Fees or Minimum Balance

BECU checking accounts are free. No monthly maintenance fees, no minimum deposits and no membership fees required to open.

Free Nationwide ATM Access

With your BECU debit card, you can access more than 33,000 surcharge-free Co-op Network ATMs nationwide. Enjoy the convenience of easy cash withdrawals, account access and everyday banking with no added surcharges.

Eligibility Requirements

To open a BECU checking account, you must first qualify for BECU membership. Eligibility is open to anyone who lives, works, worships or attends school in Washington state. Residents of select counties in Oregon and Idaho, as well as members of certain partner associations, may also qualify for membership.

What You'll Need to Apply

Have the following ready to open your checking account online:

- Valid U.S. government-issued ID such as a driver's license or state-issued ID.

- Social Security number or Individual Taxpayer Identification Number.

- Current contact information.

You can join in person at one of our Neighborhood Financial Centers, connect virtually through Video Banking, or complete your application online.

How to Open a Checking Account Online

Joining BECU online is easy. Submit a membership application. Once you're approved, you'll receive your account details and debit card by mail. Approval typically takes 3-5 business days. If you're already a member, simply log into Online Banking to open a checking account.

Apply for a BECU Checking Account Online

Have your personal information ready when applying for your checking account. You'll be asked to select the checking account type that best fits your needs. Then, fill out the form step by step. Once you open your savings account, you'll receive access to Online and Mobile Banking.

What to Expect After Opening Your Account

Once your application is complete:

- You'll receive your account number and routing number.

- Your BECU Debit Mastercard® will arrive by mail.

- You can set up direct deposit and start using mobile and online banking immediately after account activation.

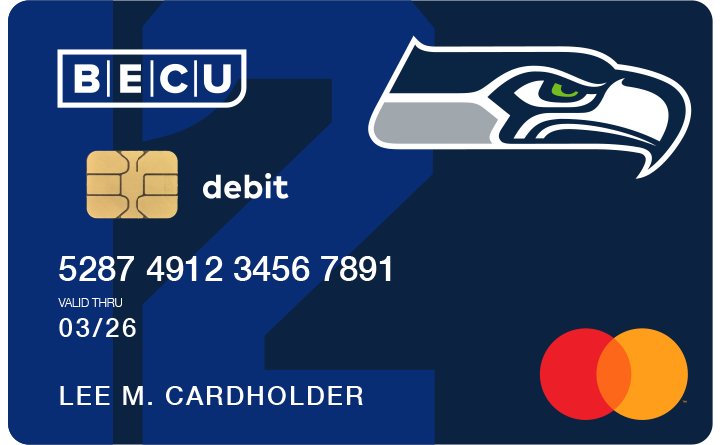

BECU Debit Mastercard® Features and Designs

Use your BECU debit card for everyday purchases, ATM withdrawals and digital wallet payments with your phone or smartwatch. Your card works anywhere Mastercard® is accepted, giving you convenient access to your funds at home and abroad.

You can personalize your account with a design that fits your community. Choose from the classic BECU card, KEXP, Seahawks, UW or WSU designs.

Frequently Asked Questions

No. BECU checking accounts come with no monthly maintenance fees.

To get your free checking account, you must first become a BECU member. Membership requires opening a Member Advantage Savings Account and meeting eligibility criteria, such as living, working or going to school in Washington state. Residents of select counties in Oregon and Idaho, as well as members of partner associations, are also within our field of membership.

To deposit checks, you can use mobile check deposit in the app or at an ATM.

Yes. You can link your BECU checking account to a savings account for overdraft protection,6 which automatically transfers funds if your checking balance is low. You can make payments or set up automatic payments from a BECU checking account to a BECU credit card account and request a credit card cash advance from a BECU credit card to be deposited to your BECU checking account.

Switching to BECU can be done online or in person. First, open a BECU account and establish membership with a valid U.S. ID. Then, transfer your funds, update direct deposits and automatic payments, and begin using your new BECU checking account. Monitor your old account until all transactions have cleared.

For step-by-step instructions, visit our guide on switching to BECU.

Related Checking Resources

1Member Share, Member Advantage, or Early Saver savings account required to establish membership; not everyone will qualify.

2To learn more about card benefits, view the Mastercard Guide to Benefits (PDF).

3Mobile and internet carrier charges may apply for Online and Mobile Banking usage.

4Once your Member Advantage account is open, you must continue to meet Member Advantage qualifications. Member Advantage eligibility and benefits subject to change without notice.

6NSF/Overdraft transfers from a linked Member Share or Member Advantage Savings to a checking or Member Advantage Checking account will be made in the exact dollar amount to bring the checking account to a zero balance.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license